Page Topics:

Tax Sale Processing

Introduction

After delinquency period, the parcel taxes that remain unpaid will be sold in Tax Sale. Tax Sale: It is the process by which real property taxes are sold to investors or sold to state. Investors can bid on delinquent taxes. Any parcels which are not sold in Tax Sale process will be Sold to State. This document will walk through the user about whole Tax Sale Process like what happens before, during and after the Tax Sale.

Pre-Tax Sale Process

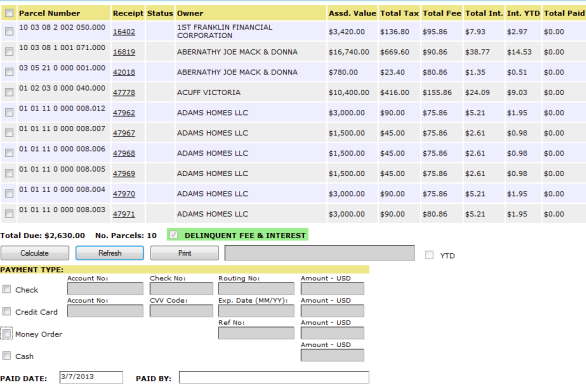

Parcels are advertised by legal description, not parcel number. After the parcels, have been advertised, a Tax Sale List is generated. The county is to generate a Delinquent List of unpaid real property the day before the tax sale. Before advertising, the Supplements and Escapes must be Processed. New Supplements and Escapes should not be created. Partial Payments should be removed from receipts & refund to the Tax Payers. And full amount is sold at Tax Sale.

Note: A taxpayer who has paid all taxes, but failed to pay a Non-Adval fee (Timber, delinquent, Fire Fee etc.) cannot go to tax sale.

Tax Sale List is Finalized a day before Tax Sale and the Tax Sale Fee will be added to all parcels automatically which includes Delinquent fee and cost incurred by the Court etc. A Tax Sale Number is assigned to all parcels before Tax Sale.

Before Finalizing Tax Sale List:

First login as Privileged User to perform Tax Sale Process.

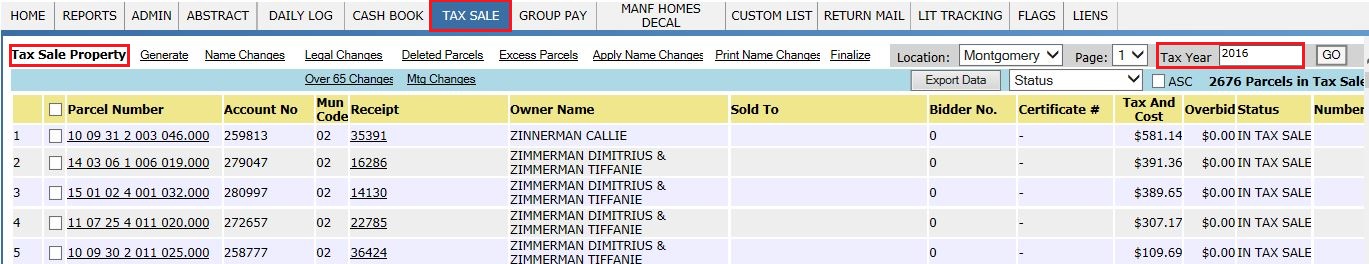

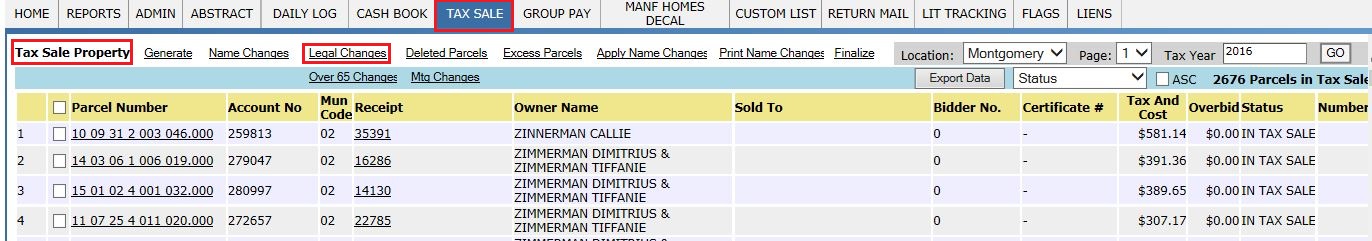

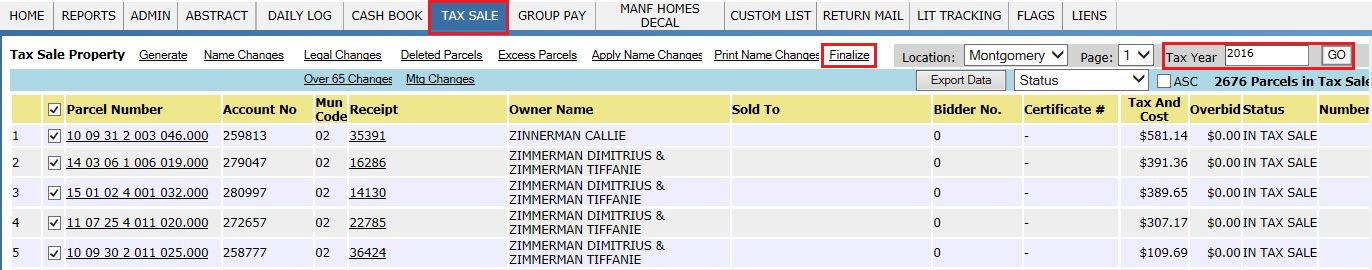

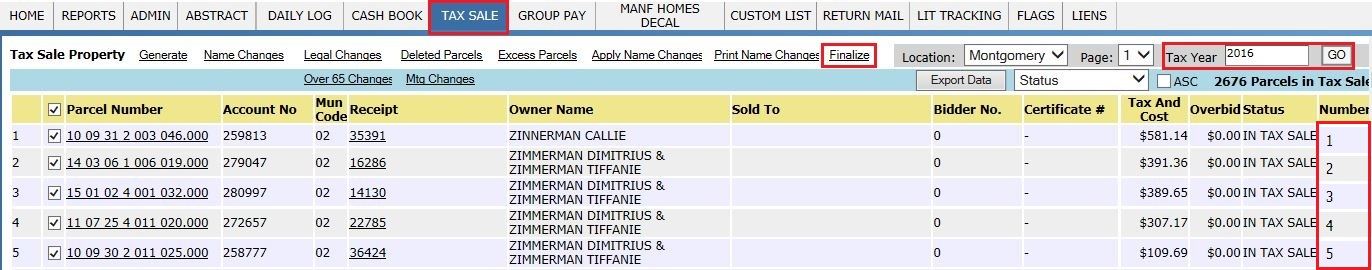

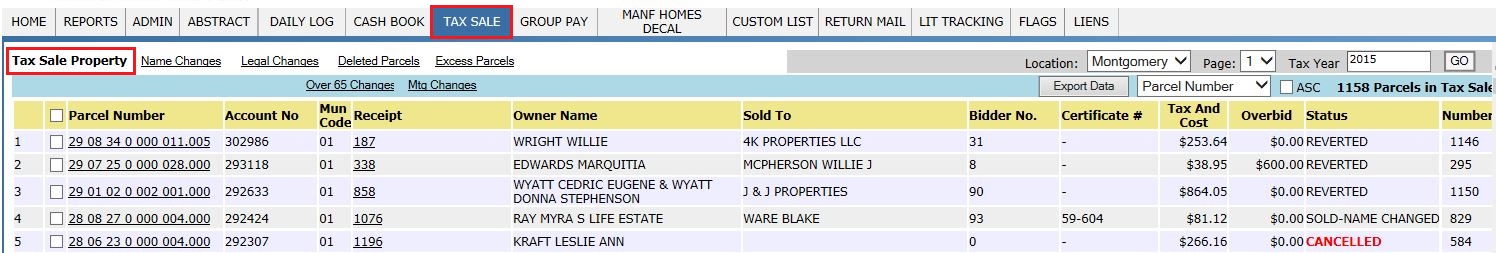

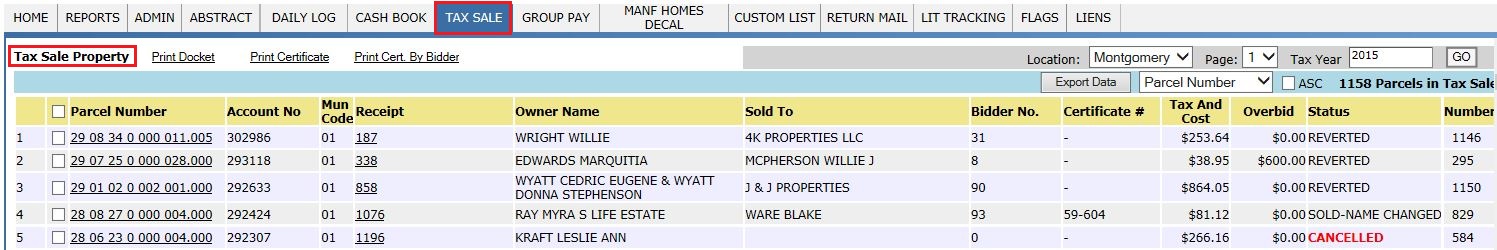

Click on TAX SALE tab which will redirect to Tax Sale Property Page, which contains all the Tax Sale Property details with respective Tax Year.

Here, it is important to make sure the most Current delinquent information is used. At this stage, User shouldn’t finalize the List.

In Tax Sale Page, Verify the Parcels which have Name Changes, Legal changes and Deleted parcels through hyper link in current year.

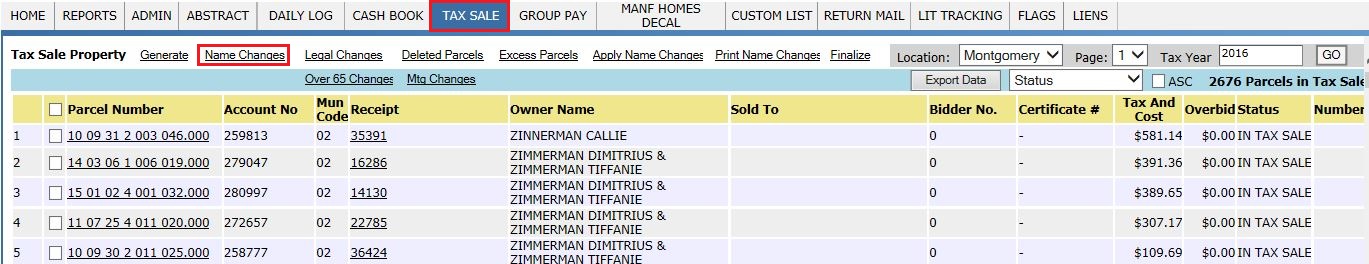

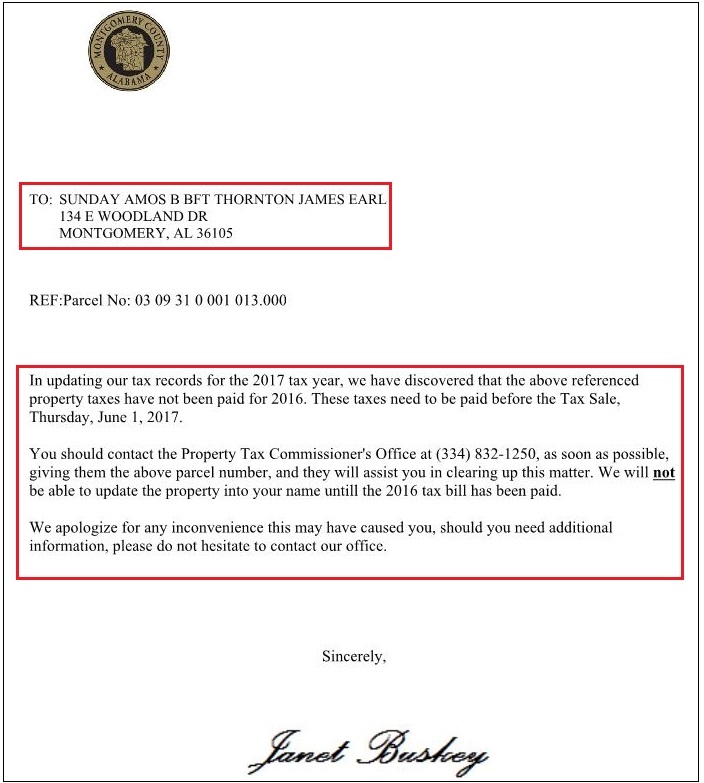

Name Changes: If any Name Changes happened in Current Year and the Old owner is not interested to pay the taxes which leads the property to tax Sale. So, User will send the notices to New Owners saying that the property taxes have not been paid for current year. These taxes need to be paid before the tax sale.

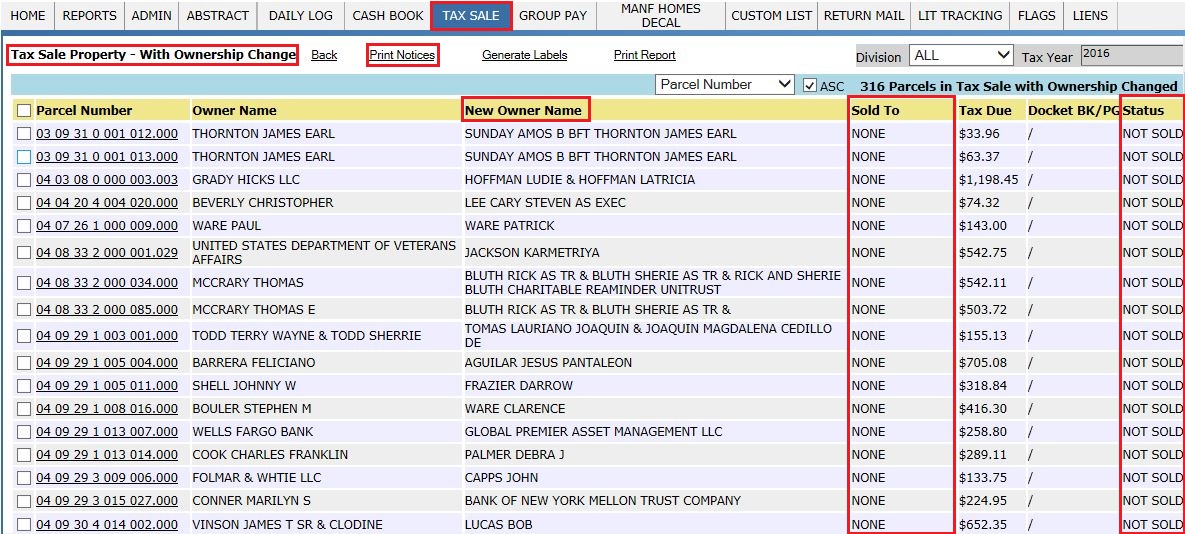

Click on Name changes hyper link, which redirects to Tax Sale Property - With Ownership Change Page.

In Tax Sale Property - With Ownership Change Page, User can see the Old Owner and New Owner details with respective Unpaid Tax details. And from this Page User Can Print Notices to New Owners through Print Notices hyper link.

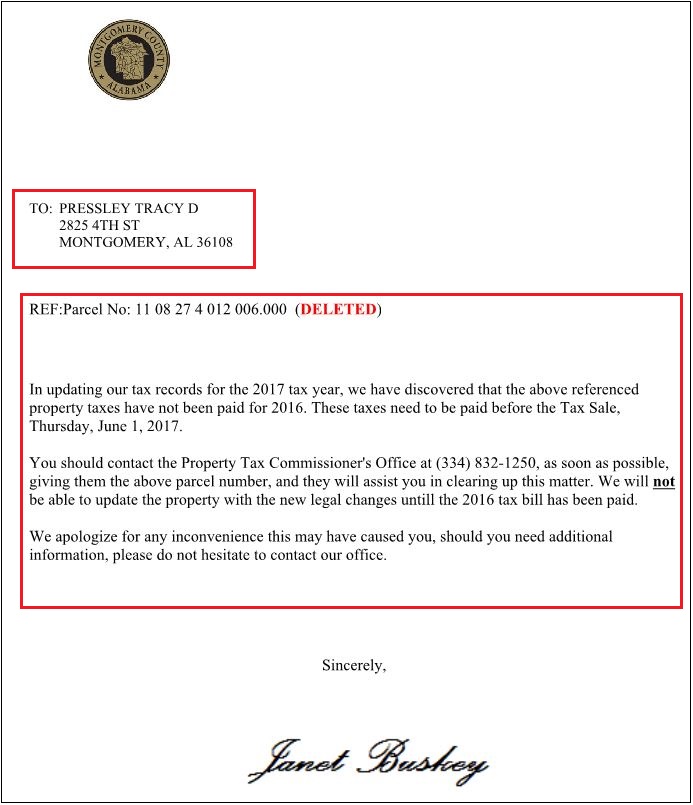

Sample Notice to New Owners.

Generate Labels: It will show all the new owner names and respective mailing addresses.

Print Report: This will print all the Tax Sale Property - With Ownership Change details.

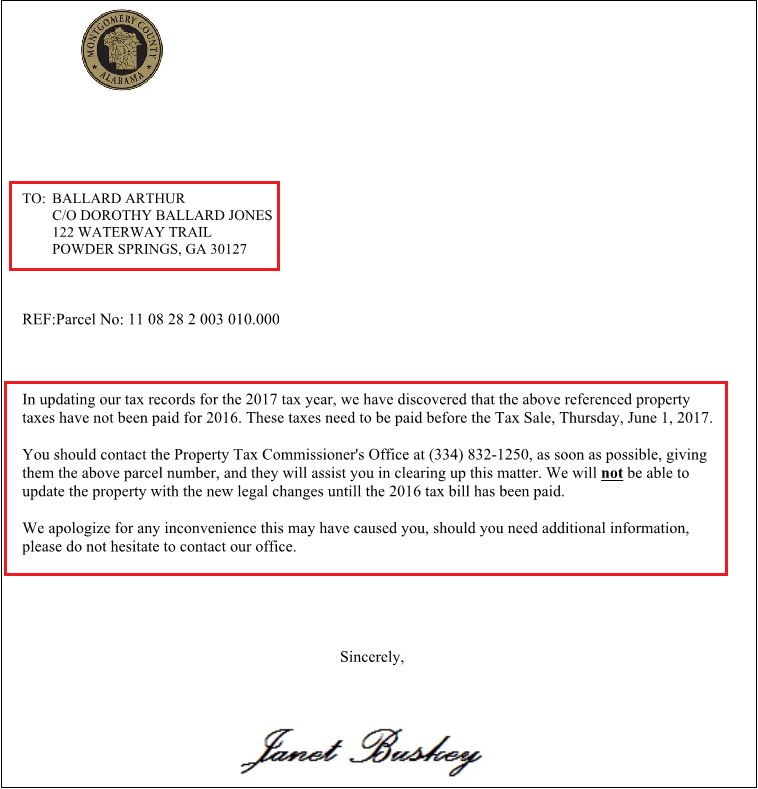

Legal Changes: If any Legal Changes happened for future Year through Spilt. By law processing Legal Change on properties which are in Tax Sale is Illegal. So, User will send the notices to Owners saying

that the property taxes have not been paid for current year. These taxes need to be paid before the tax sale.

Note: If Taxes are unpaid for current year then the legal changes for future year are not valid.

In Tax Sale Property - With Legal Change Page, User can see details of Parcel no., Owner Name, Unpaid Tax details with respective Status. And from this Page User Can Print Notices to Owners through Print Notices hyper link.

Sample Notice Owners.

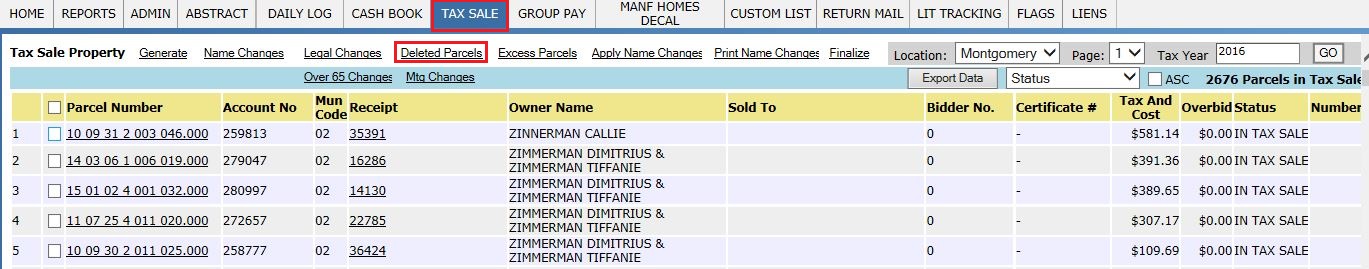

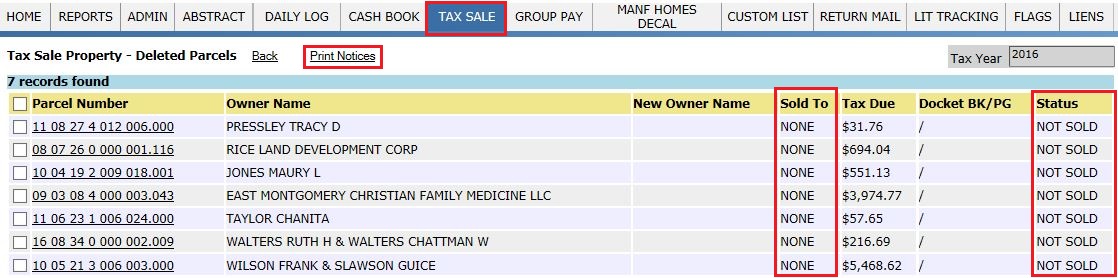

Deleted Parcels: If any parcel Merge with other parcel through Legal Changes, those Deleted parcels are tracked by the county to avoid the loss of taxes and then the parcel will be virtually deleted. And User will send the notices to Owners saying that the property taxes have not been paid for current year. These taxes need to be paid before the tax sale.

In Tax Sale Property - Deleted Parcels Page, User can see details of Parcel no., Owner Name, Unpaid Tax details with respective Status. And from this Page User Can Print Notices to Owners through Print Notices hyper link.

Sample Notice Owners.

After Sending the Notices, the tax Payers who pay the unpaid taxes, those parcels are removed from Tax Sale.

Day Before Sale

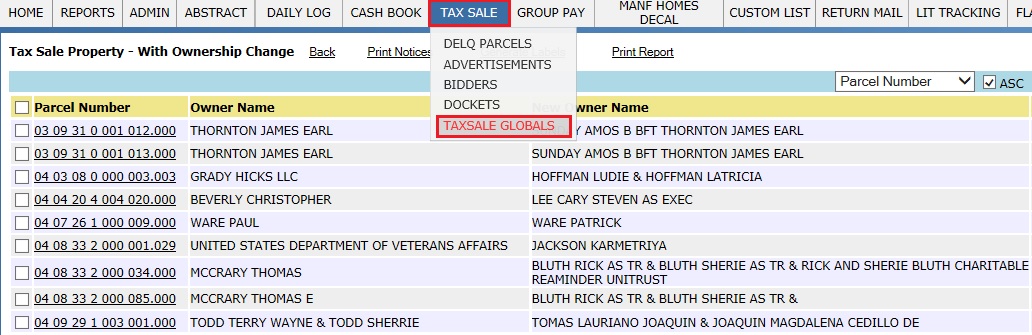

It is also recommended that customers update the Tax Sale Globals at this stage.

Hover over TAX SALE > TAXSALE GLOBALS. Here, User can setup the Tax Sale Globals like ADVERTISEMENT_DATE, NEWSPAPER_NAME, TAX_SALE_LOCATION1, TAXSALE_ENDDATE etc.

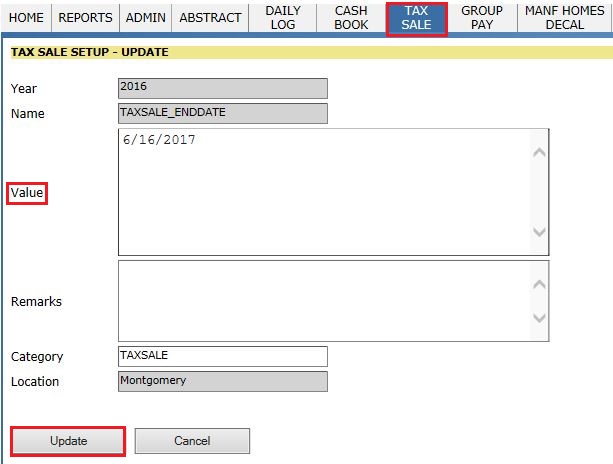

Here, User can TAX SALE SETUP – UPDATE by providing required details and click on Update button.

After updating the Tax Sale Globals.

If County wants to use previous Year TAX SALE Globals setup, then they can Directly import the data by using Copy Previous Year Setup button in above screen shot.

After processing all Delinquent Parcels List and verifying it, the Tax Sale List can be Finalized by clicking on Finalized Hyper Link.

Finalizing the Tax Sale List assigns a tax sale number to each parcel. This number represents the order in which the parcels will be sold. The order is set alphabetically by the owner’s last name.

Notice that the parcels still have the status In Tax Sale after the numbers have been assigned.

Note: Finalizing the tax sale will also add the $5 Tax Sale Fee to the parcels based on county.

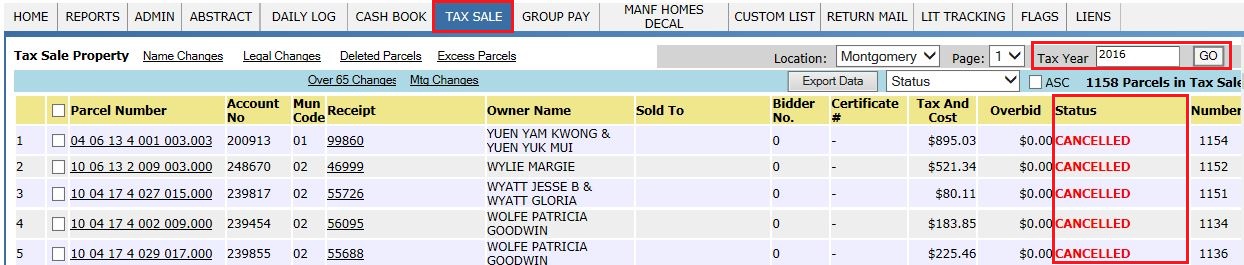

During this time, taxpayers still can pay their taxes. Any parcels that are paid after the Tax Sale List has been finalized will have the tax sale status of Cancelled as shown in below screen shot.

Day of Tax Sale

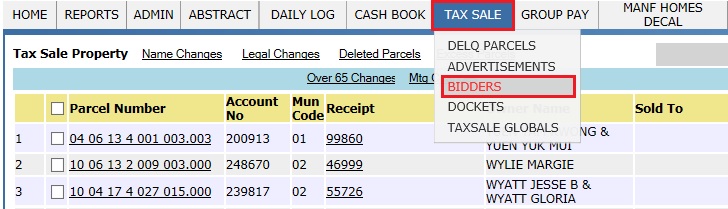

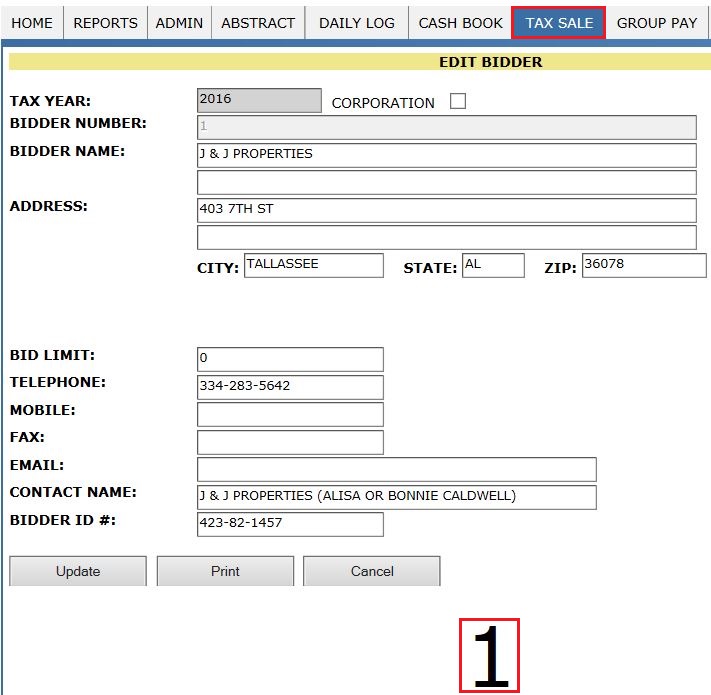

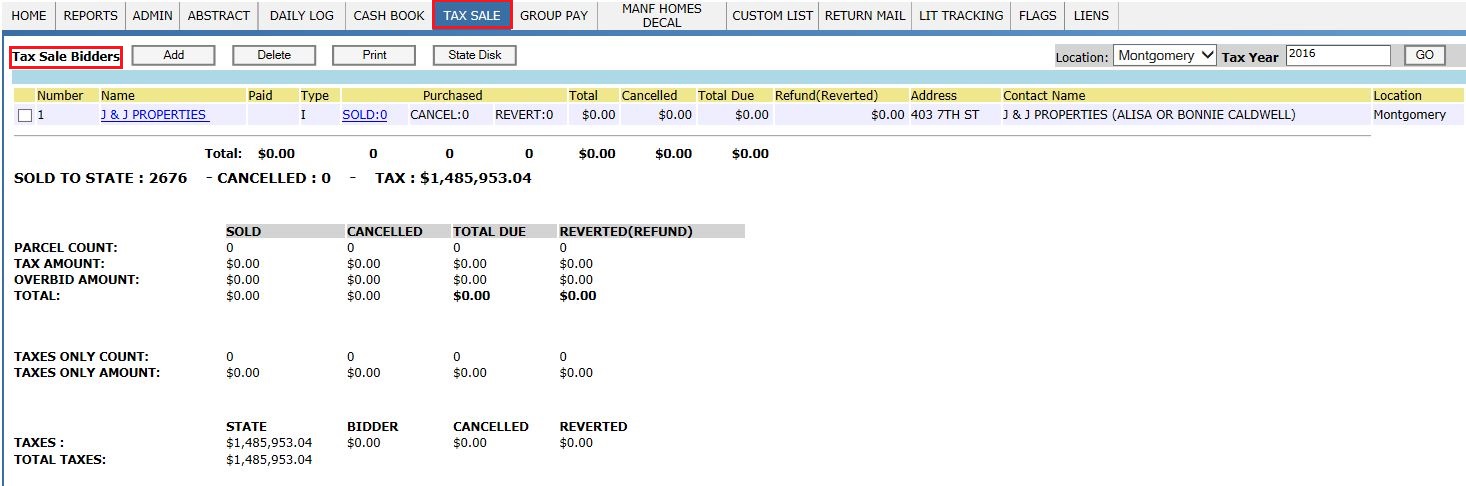

The Tax Sale Bidder who arrives must be registered and assigned a bidder number that is printed out by Print button and handed to each bidder. Hover over TAX SALE > BIDDERS which redirects to Tax Sale Property.

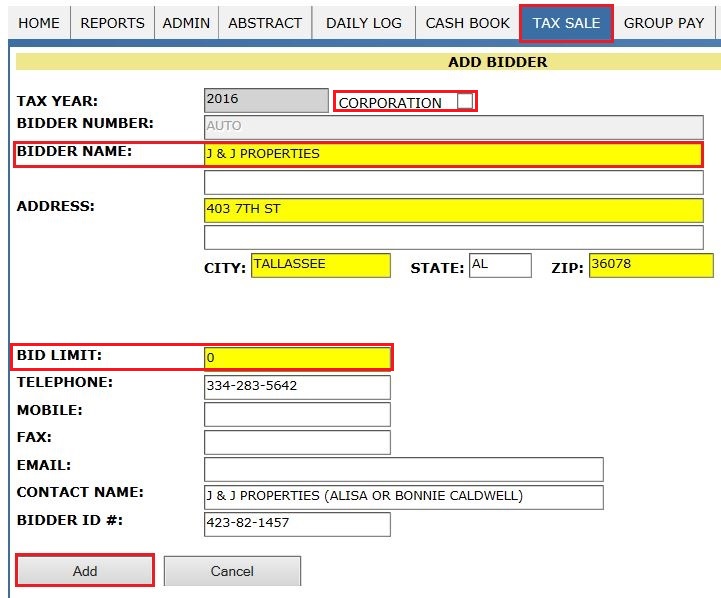

To Register Bidders, Click on ADD button with respective Tax Year which redirects to Add Bidder Page.

Enter the bidders’ information and Click on Add button which will automatically assign a bidder number, which is used to identify them during bidding.

Note: If the bidders are from Corporate, then mark the CORPORATION checkbox.

After Adding Bidder, a bidder number will assign in the half of the Page along with bidder information as shown in below Screen shot.

State Disk: This contains all parcel data which is sold to state. This information can be used by potential investors who want to purchase parcels from the state.

Owners can still pay Total Tax Due the day of the tax sale, if the parcel has not been sold yet.

Bidding

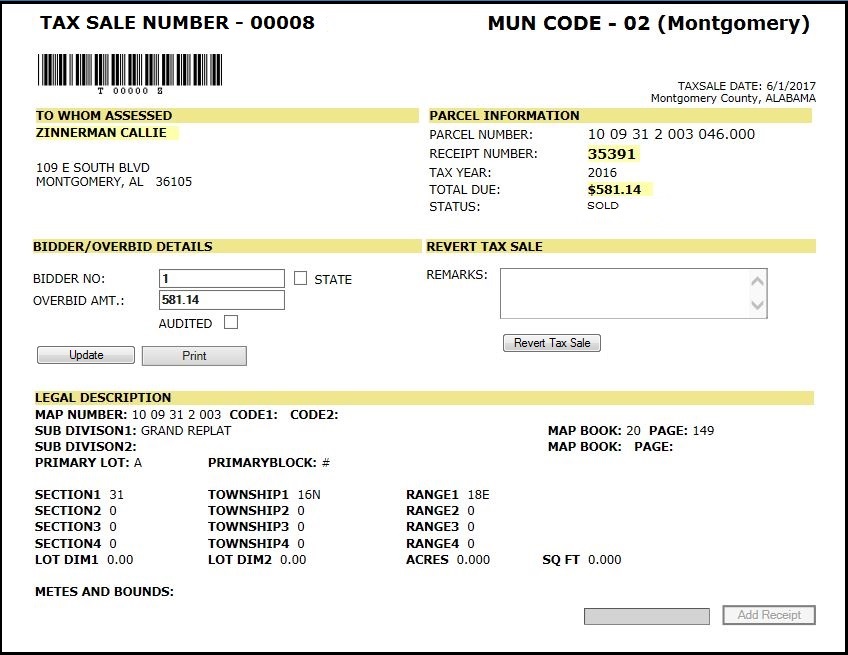

1. Sold to an Investor for tax and cost amount: A Bidder can purchase a parcel for tax and cost amount (fees and interest) or a bidder can overbid up to certain Limit.

From above Screen shot, the investor bid on this tax sale parcel for tax and cost.

Note that the Overbid Amt. entered is the same as the Total Due in the parcel information section. The status of the parcel is now SOLD.

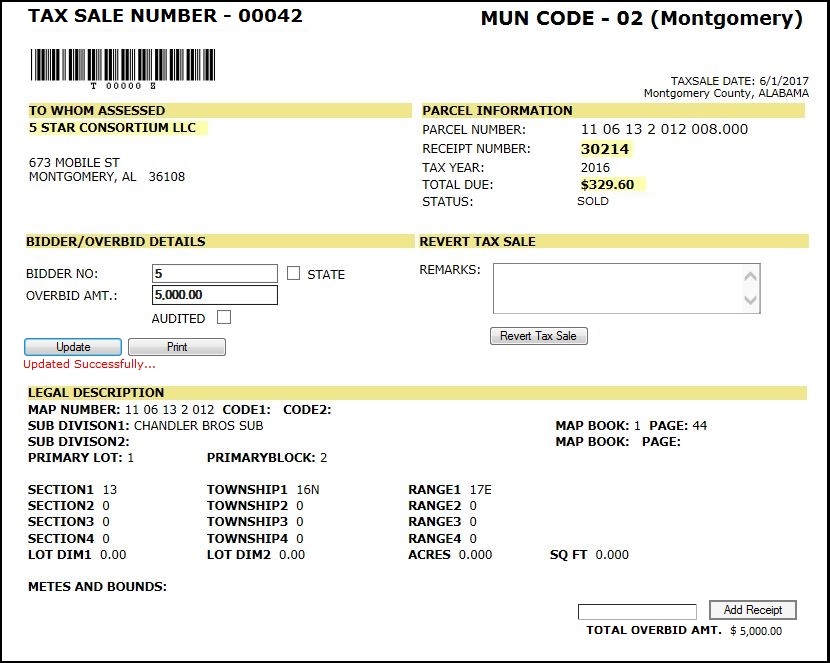

2. Sold to an investor for tax, cost, and overbid amount: An overbid is an amount over, what is due. A person may overbid because it is an investment opportunity.

In the above screen shot, if tax, cost, and an overbid are submitted by an investor. Note that the Bid Amt. entered is higher than the Total Due in the parcel information section. The Total Overbid is equals to Overbid Amt. The status of the parcel is now SOLD. The Bidder will accrue interest on the Tax, Cost, and Overbid amount up to a certain percentage. The overbid will only receive interest up to 15% of the market value. So, a person can overbid by 20% of the market value, but they will only accrue interest on the 15%. The Bidder earns 12% a year on this investment.

Note: The Tax Payer doesn’t have to pay back the overbid amount (but the investor will receive it back). Delinquent taxes paid by investors are considered a charge during Final Settlement.

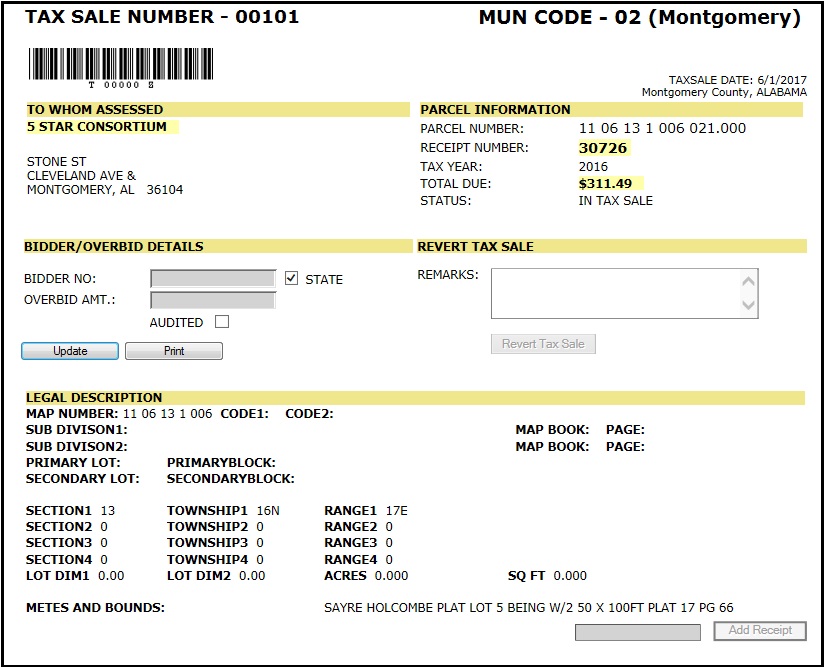

3. Sold to the State: If a parcel is not Bid on during Tax Sale, then it is Sold to State. Money is not exchanged for parcels sold to state; instead credit is taken on those parcels during Final Settlement.

In the above screen shot, the parcel was Sold to State.

Note that the State box next to the Bidder No. is checked to mark the parcel Sold to State.

Remember that during the tax sale, taxpayers still can pay their taxes. If a taxpayer does pay during the sale, then it must be reverted from the PRC - Tax Sale page.

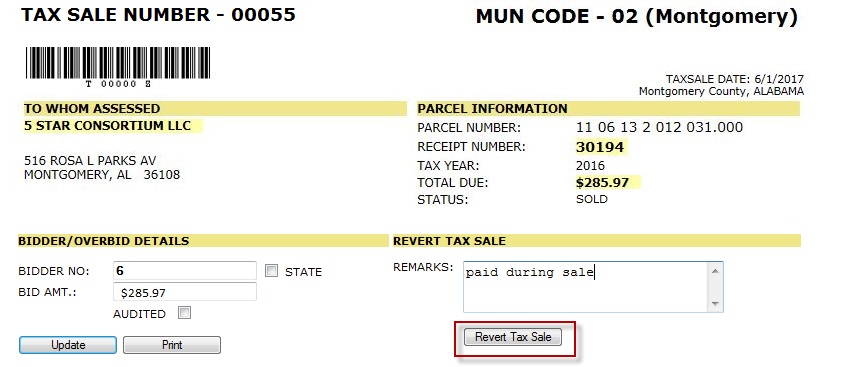

Reverted: When a tax sale is Reverted, Enter the Remarks (Reason) in the below screen shot.

Noted that the sale is reverted due to owner payment during tax sale.

After clicking the Revert Tax Sale button, the Status changes to Cancelled as shown below.

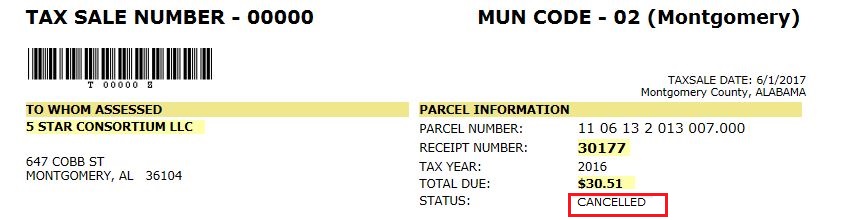

Cancelled: Any parcel paid by the taxpayer before an investor pays on the parcel will have Status as Cancelled, as shown below.

Note: If a county does not accept payment during tax sale then any payments made by the owners will result in the Status of Reverted, as shown below.

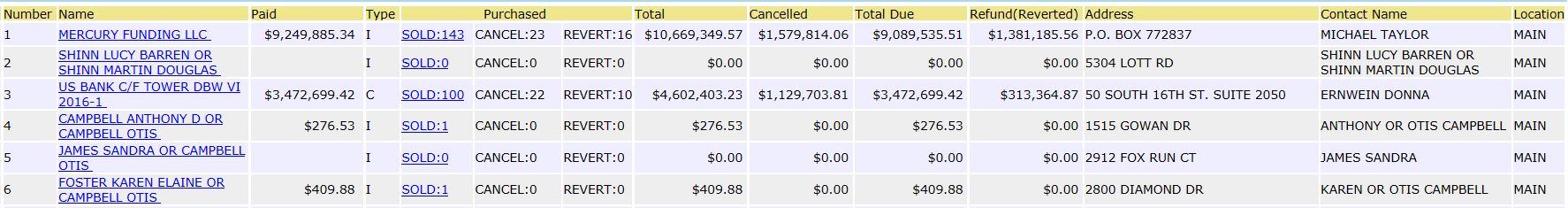

After the payments, as per the county’s procedure, the Bidder List shows how many parcels each bidder purchased, the total number of sales Cancelled and Reverted, the Money Due, and the Refund due to the Investor.

Bidder Payments

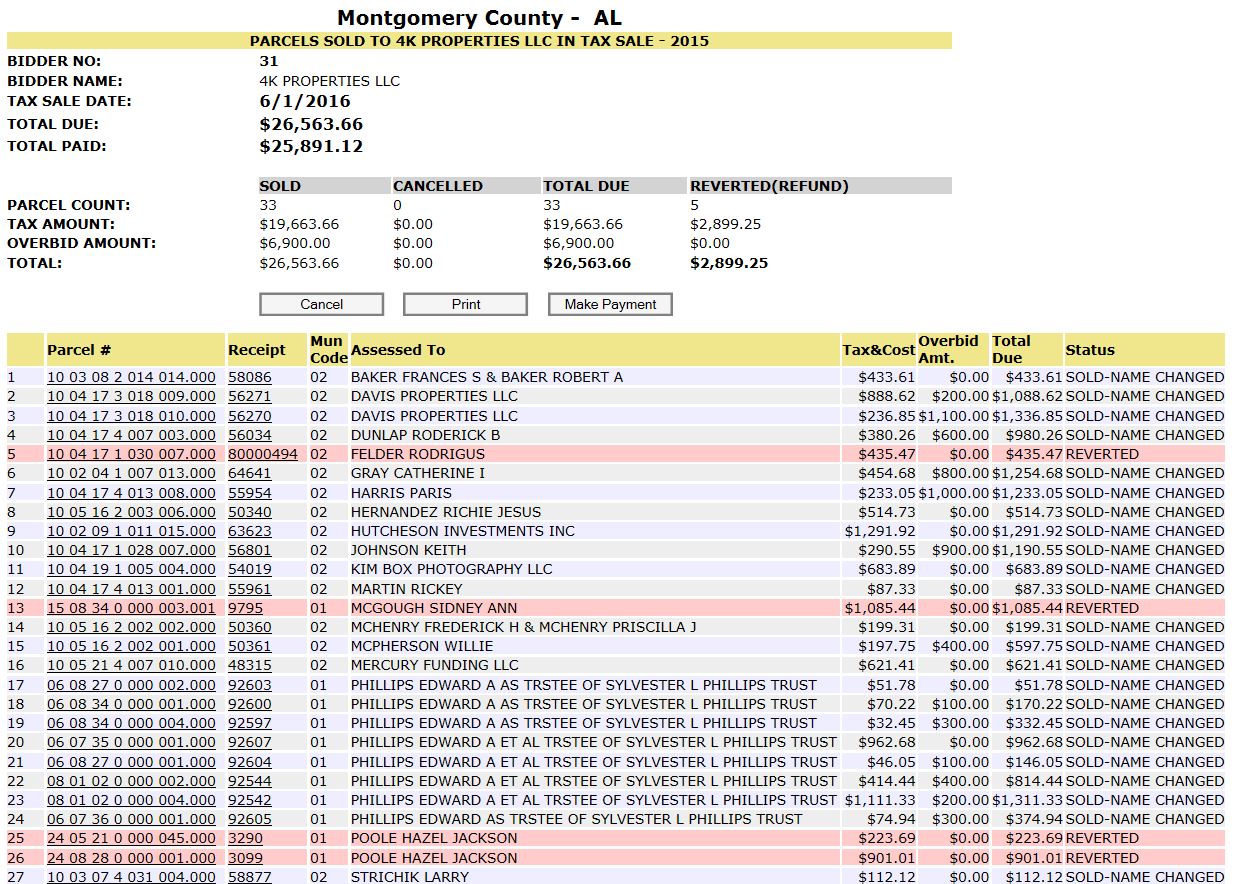

Note: Cancelled parcels are not charged to the investor. Reverted parcels are refunded to the investor. Clicking the SOLD link opens a summary of the parcels that the bidder purchased as shown in above screen shot.

Bidder Purchase Summary:

In the Bidder Purchase Summary, Cancelled or Reverted parcels are highlighted in red. Clicking the Make Payment button opens the Group Pay screen where payment is posted.

Bidder Group Pay page:

Payment is entered on the Bidder Group Pay page similarly to the Single Pay and Group Pay pages.

Post Tax Sale Process (After the Sale)

Once Tax Sale process is completed, there is still some time for the owner (tax payer) to pay taxes on their property. Any parcels that are paid for by the owner during the grace period will have the status of Reverted. It is recommended that the tax sale and grace period occur within the same disbursement period. This should be done to ensure that there will be enough money to issue any refunds.

Grace Period: This is the time in which the owner can come in and pay the tax before the parcel goes into Redemption. If the owner pays during the grace period, then the investor is fully refunded and the parcel is put back in the owner’s name. No interest is collected by the investor because the parcel is not yet in Redemption.

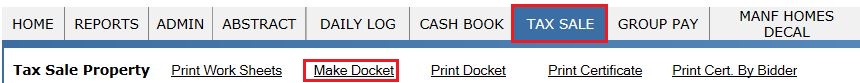

Post Grace Period: Once the grace period is completed, the Docket is created for the tax sale parcels. The Name Changes are made to the parcels and a docket is created for those name changes with a book and page number assigned. The Docket is an official list of all parcels sold in tax sale.

The Make Docket link is available on the Dockets page. After clicking the link, the user is prompted to enter the book number, which is usually the Tax Year. The docket is then created with the tax sale number as the page number. The docket is printed and bound.

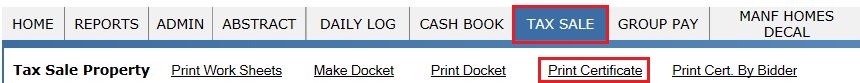

Certificates are sent to the investors for the parcels that they purchased and were not reverted. These certificates are printed using the Print Certificate hyper link and mailed to the investors from the Dockets page.

Because, this information is given to Probate and it provides a record of what took place in tax sale. Investors receive a Sales Certificate during this time. Parcels sold to state are included in the State Disk and sent to the State. This list is created to keep a record of sold to state parcels and it provides a way for investors to view said parcels and potentially purchase the liens.

To access the State Disk button, go to the Bidders page in Tax Sale.

Finally, Name Changes must be applied to the tax sale parcels. Click the Apply Name Changes link on the Tax Sale page.

Once the Name Change are applied, the owner name is changed to the investor who bid on the parcel. If the parcel was sold to state, the owner will be the respective State Name.

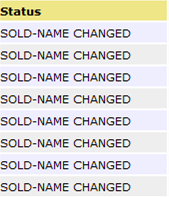

Sold-Name Changed status: The status of the parcels will now be Sold- Name Changed.

After the Tax Sale is run and all the above changes are made, Final Settlement takes place.

Reports Used in Tax Sale

Tax Sale Report: All properties related to Tax Sales will be shown here and used by User/Supervisor.

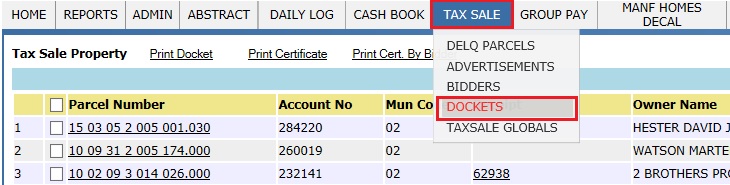

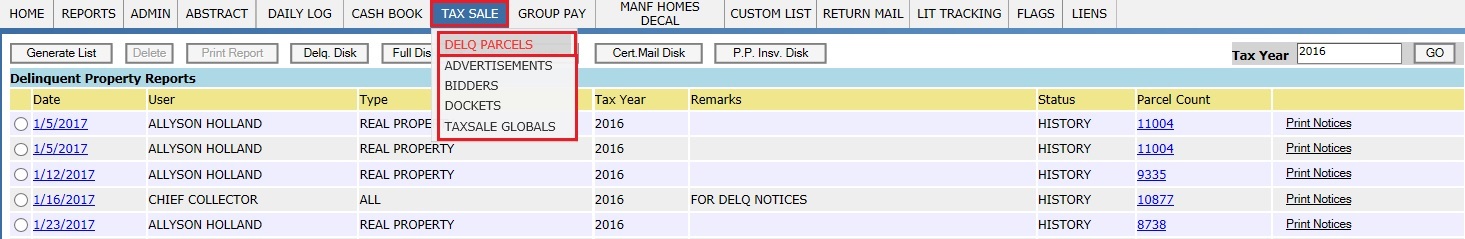

Hover over on Tax Sale, to view other Tax Sale Related Reports.

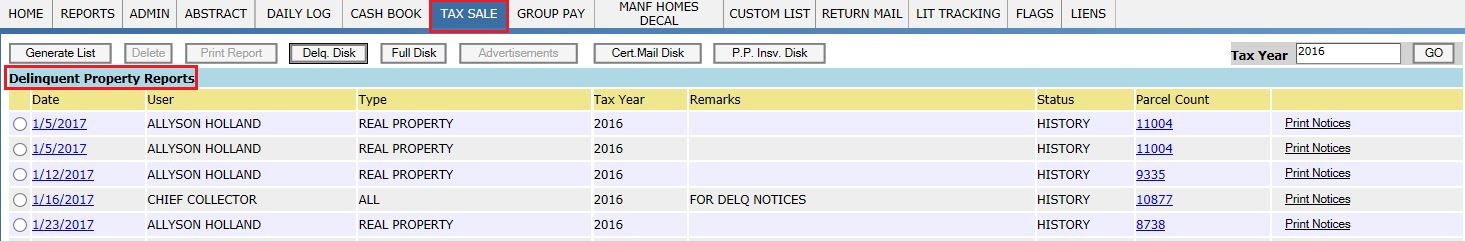

Delinquent Parcels Report: All delinquent properties will be shown here with respective Tax Year, Date etc. and used by User/Supervisor.

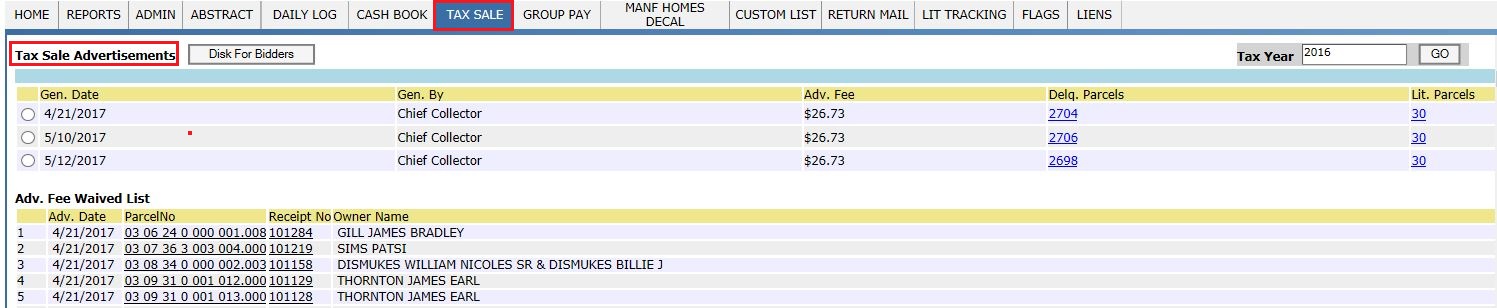

Advertisements Report: All Tax Sale Advertisements parcels list with respective Adv. fee and Delq. Parcels etc. are shown here and used by User/Supervisor.

Bidders Report: This report shows All Tax Sale Bidders details and used by User/Supervisor.

Dockets Report: This Reports shows all Created Dockets which of all tax sale processed properties and used by User/Supervisor.

Tax Sale Globals Report: Total Tax Sale Setup will be shown here and used by User/Supervisor.