Page Topics:

Mortgage Processing

Coding Parcels

· Some Counties who expect few parcels to be paid by mortgaging companies will not send tax bills to those parcels. This can save significant amounts on postage.

· To determine these parcels which are expected to be paid by mortgaging companies, an initial file is sent to the mortgaging company during the summer so that they can determine which parcels they need to cover.

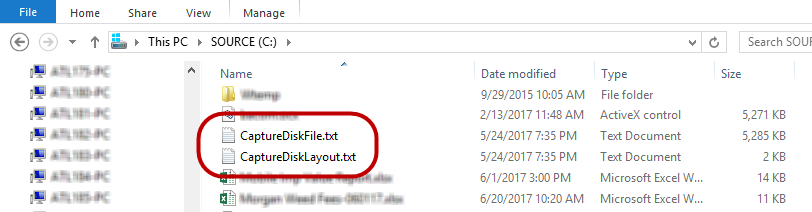

· The county will send a Full Disk and in return will receive a coding file. This coding file is just a list of parcels and can be imported into Capture so that each parcel to be paid by that company has a mortgage code related to that company.

· Later when the tax bills are generated, parcels with those mortgage codes will not be printed.

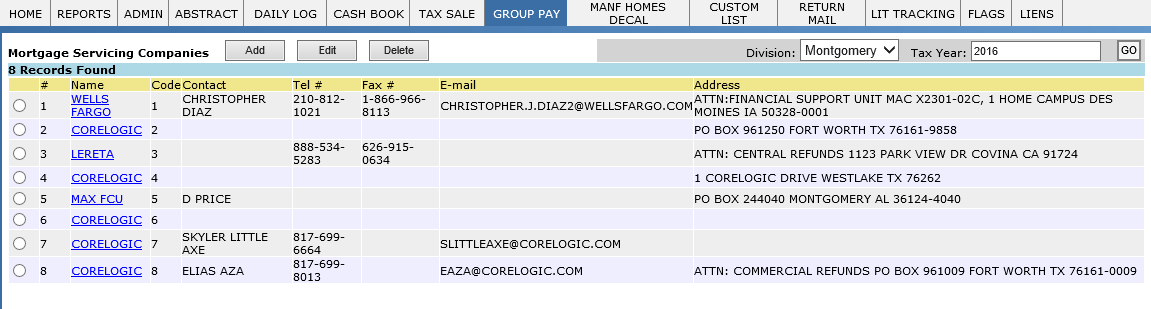

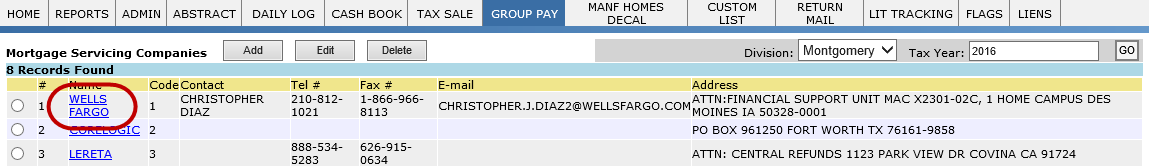

· The mortgage coding process also creates an account for the mortgage company in Capture. This account will be used to record all aspects of the payment process including parcel lists, payment posting, and refund processing. These accounts can be seen in the Mortgage Servicing page.

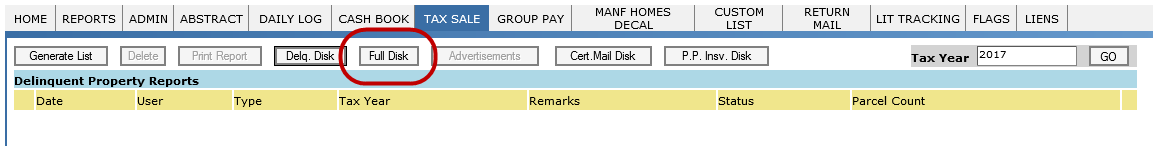

Creating The Full Disk

· The full disk is a single file that contains every parcel in the County with amount due and other relevant information. The mortgage companies will process it to determine the parcels they are responsible for, based on owner and legal description.

· To create a full disk, hover over TAX SALE tab and select DELQ PARCELS. Click the Full Disk button.

· Two files, CaptureDiskFile.txt and CaptureDiskLayout.txt will be created in the C: drive. Both should be sent to the mortgage company.

Importing The Payment File

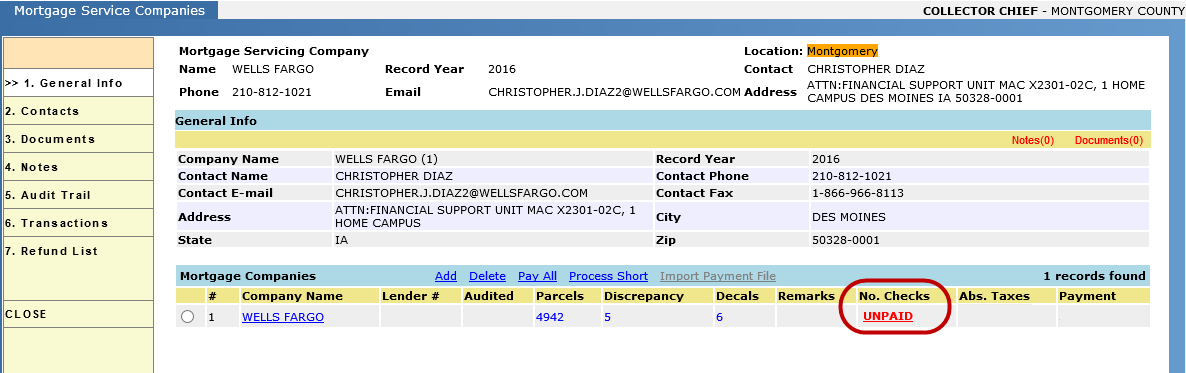

· The mortgage company will send a payment file after receiving and processing the Full Disk. Select Mortgage Servicing under the Group Pay tab and click the Mortgage Company’s name to open its dashboard.

Processing A Mortgage Account

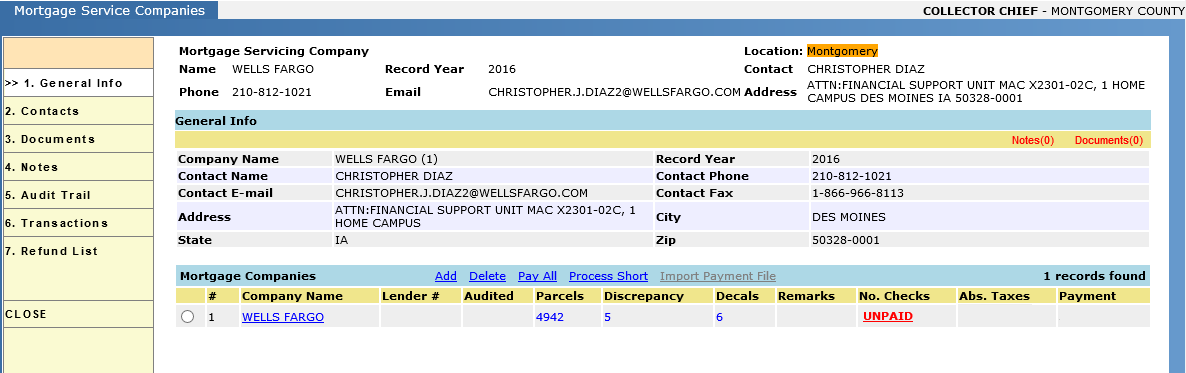

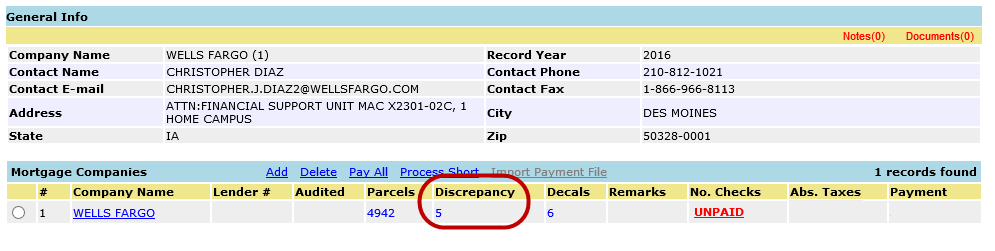

· On the Mortgage Service Companies dashboard, the mortgage company will be listed with the number of sub accounts, total parcels, total discrepancies and the number of decals required. If the numbers of parcels and discrepancies match, there was a problem importing the file.

Handling Discrepancies

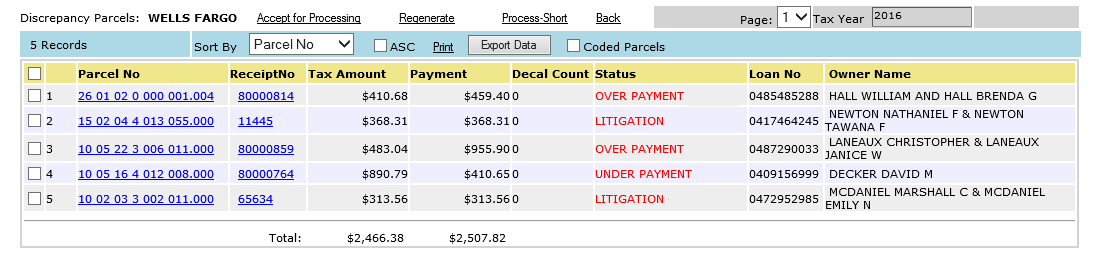

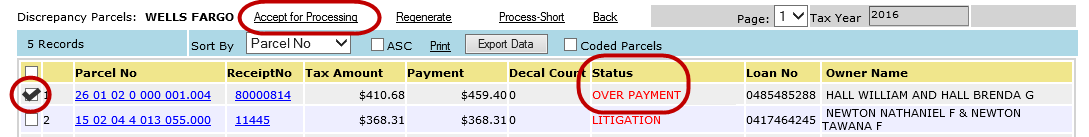

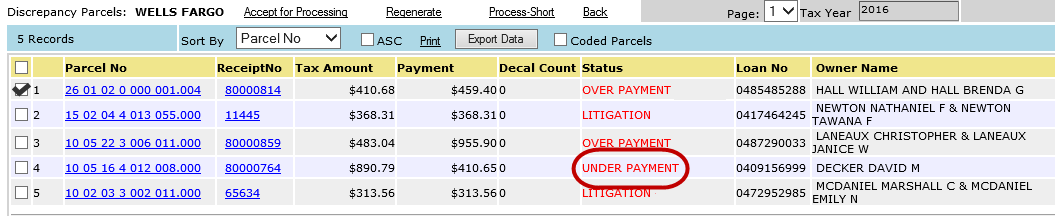

· Click the Discrepancies number to access a list of payments Capture regards as inaccurate.

· Capture adds any parcel to this list where the amount listed in the payment file does not match the balance due on the actual receipt. Other discrepancies may involve additional amounts that must be covered such as redemptions, escapes, or related personal property accounts. The most common discrepancies are overpayments and underpayments.

Overpayments: Overpayments indicate that the payment sent is higher than the amount due on the parcel. If the overpayment happens because the parcel was supplemented to a lower amount, the payment can go through and a refund will be generated automatically. If the overpayment was due to a payment from the property owner, the county can choose to refund either the property owner or the mortgage company depending on their own policies.

· To allow the payment to go through despite the discrepancy, checkmark the parcel and click Accept for Processing.

Underpayments: Underpayments indicate that the payment sent is lower than the amount due on the parcel. In these cases, the county may choose to reject the payment and inform the mortgage company that the taxes due are higher than expected. This allows the mortgage company to send the corrected amount and increase the escrow on that parcel. The payments that were not applied will be refunded to the mortgage company.

· For rejecting a payment, do not checkmark the parcels when accepting any other payment for processing.

Making Payments

· Mortgage company payments are posted directly inside the Mortgage Service Companies dashboard. To make a payment click the UNPAID link next to the Company Name.

· The payment screen that appears functions similarly to Single and Group Pay screens. The payment can be posted as a single transaction or as multiple transactions per check.

Note: When posting checks as multiple individual transactions, the checks must be posted in increasing order of dollar amount.

· Mortgage companies may send multiple checks to cover their parcels. Capture does not apply individual checks to individual parcels through Mortgage Processing. Instead all checks are applied to the total.

· Because of discrepancies, the total amount sent is usually less than the amount that will be applied. Also, Capture will only allow the checks to be posted to the point where the balance is covered. Posting the checks in increasing order ensures that the checks are all recorded in Capture and the total refund is pulled exclusively from the last, largest check.

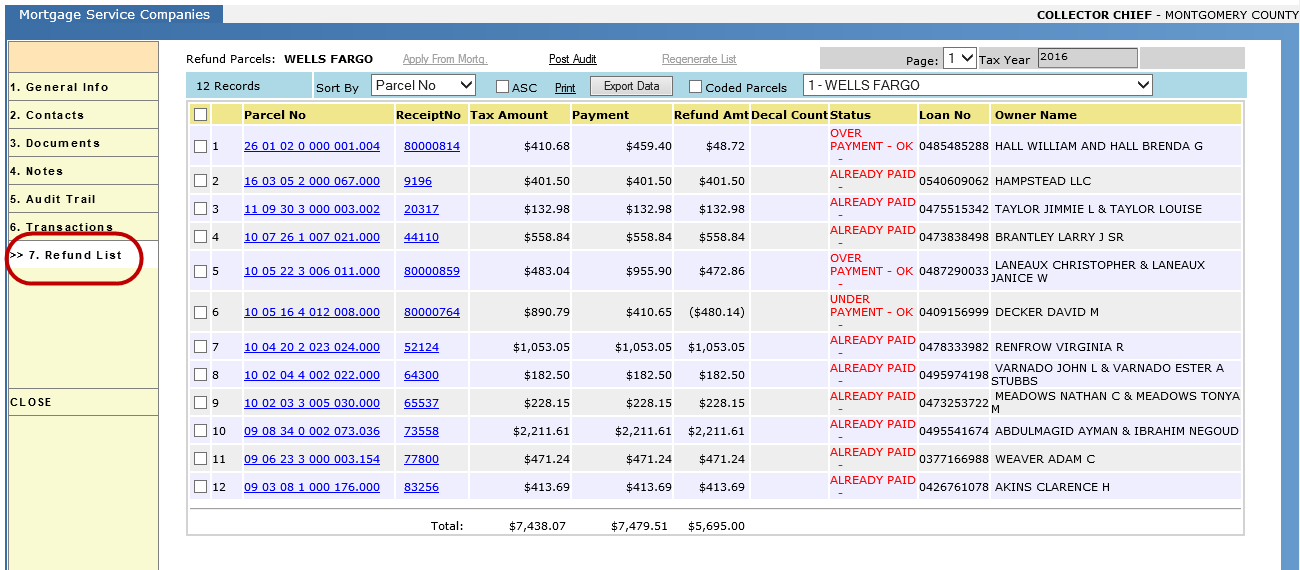

Refund List

· A list of refunds must be sent for each sub account. This will allow them to adjust the parcel’s escrow and send corrected payments on parcels that were underpaid. Capture does not create individual refunds for each parcel so this list is crucial.

· Select Refund List on the left-side menu. The Refund page can be printed or exported to Excel to send to the mortgage company.