Page Topics:

-

-

Final Settlement

Introduction

· Final Settlement is done at the end of the collection cycle to verify whether each individual agency received the correct amount of money from the collection cycle.

· Final Settlement shows the details of why there are discrepancies between what was abstracted (to be collected) for each agency and what was remitted.

· The abstract is created before the collection cycle to show each agency what they can expect in payments once the taxes are collected. If $100,000 is abstracted and the tax bills went out and were paid in full, then the final settlement will match the abstract.

· In the final settlement, any money originally abstracted to be collected is a charge. Money that was abstracted and not collected as intended is a credit (except for remittances).

Case Setup: Validation of Final Settlement for State (DFC 12)

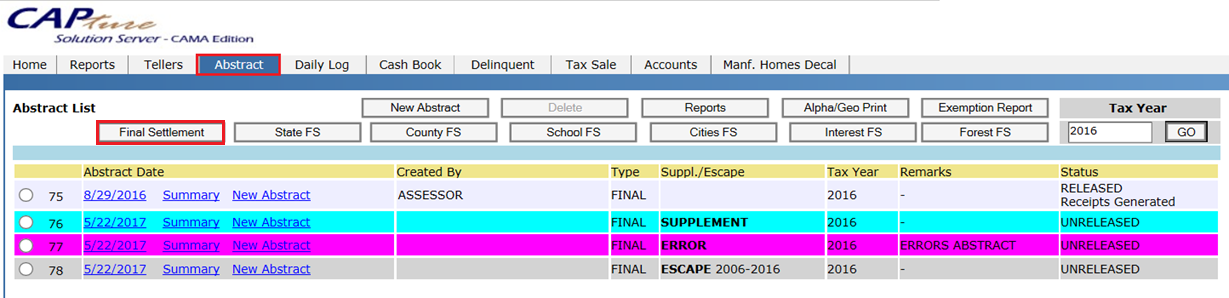

· Login as a privileged collection user.

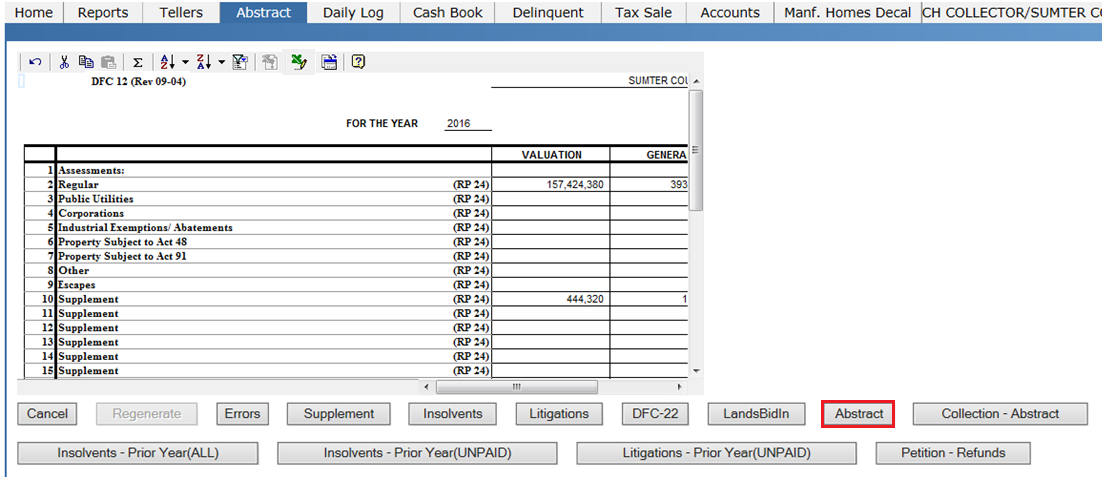

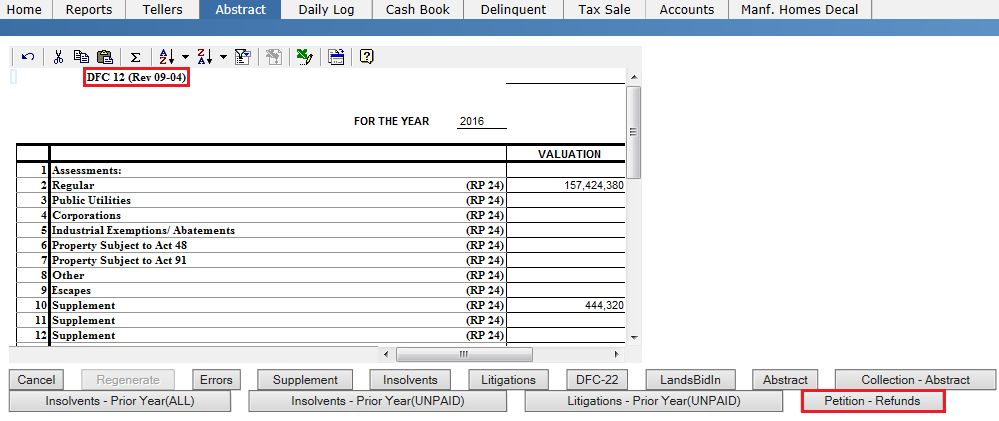

· Click on abstract and give the required tax year to be validated.

· Then click on final settlement link example State, County, Cities, Forest, Final Settlement etc.

· To validate a State final settlement, click on Final Settlement link and then export the page.

Charges and Credits

The collector is responsible for collecting all the charges that appear on an abstract. If the collector does not collect everything on the abstract, an explanation must be provided. Anything that has not been collected is taken as a credit by the collector. If a credit is not taken, then the collector would be responsible for paying that money out of his pocket.

Charges

· The original (regular) abstract provides most of the charges collected by the collector during the tax collection cycle. Additional charges include escapes, supplements, interest etc.

· Abstracted Assessments are the amounts that are abstracted and then billed.

· Escapes are collected during the year from parcels that have escaped taxation in previous years.

· Supplements are charges that are the result of corrections made to the existing tax bills. Since the abstract cannot be adjusted, if a tax bill is adjusted, then a supplement is created. A supplement may cause an increase or decrease in the taxes owed.

· Interest is any money accrued on what is owed due to failure of payment before January 1st.

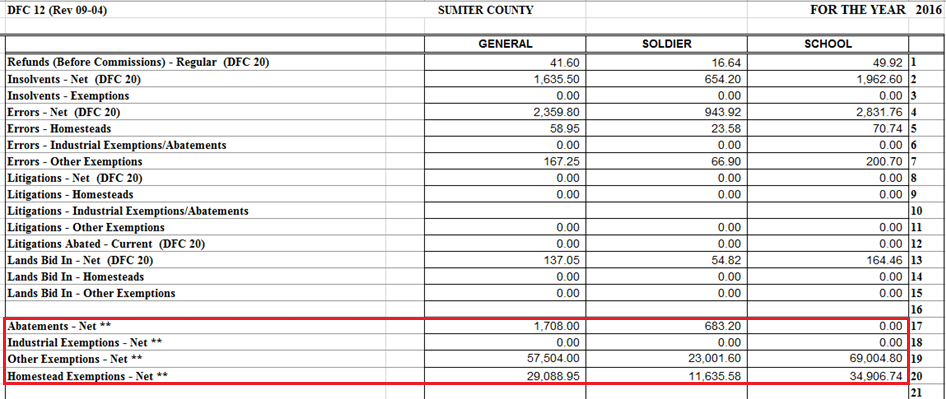

Credits

· Whenever a collector does not collect an amount from the abstract, it must be taken credit for. Credits include errors, insolvents, litigations, parcels sold to state in tax sale, petitions, budgets, commissions withheld etc.

· Errors are receipts that have been voided due to a correction in the tax bill. When a tax bill is supplemented, the original receipt is voided and a new receipt is created and collected.

· Insolvents are personal property accounts that are delinquent and have not paid taxes.

· Litigations are real property or personal property accounts that are under court protection and do not have to pay taxes currently.

· Parcels Sold to State (Lands Bid In) are parcels that have been sold to the State through a tax sale. When the State receives a parcel through a tax sale, the State does not actually pay for the parcel. Therefore, the taxes owed must be credited.

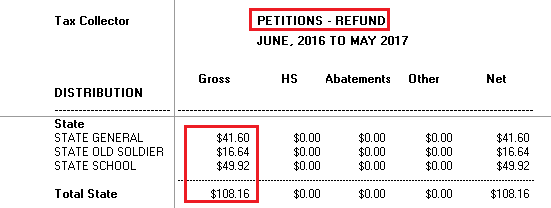

· Petitions are filed by a parcel owner because he or she believes too much was collected in taxes in a previous year. If the board of equalization agrees, then a refund is given to the parcel owner and the collector must take credit for that amount.

· Budgets are amounts withheld from the agencies each disbursement period until the total budget is met.

· Commissions Withheld are the amounts withheld for payment to the County commission funds.

Charges and credits can also be thought of in equation form:

Remittance

= Abstract – Errors + Supplement + Escape – Insolvent – Litigation – Parcels

sold to state –

Petitions

+ Interest – Commissions Withheld – Budgets

If the equation does not balance, then there is a discrepancy in the report and further investigation is required to find the discrepancy.

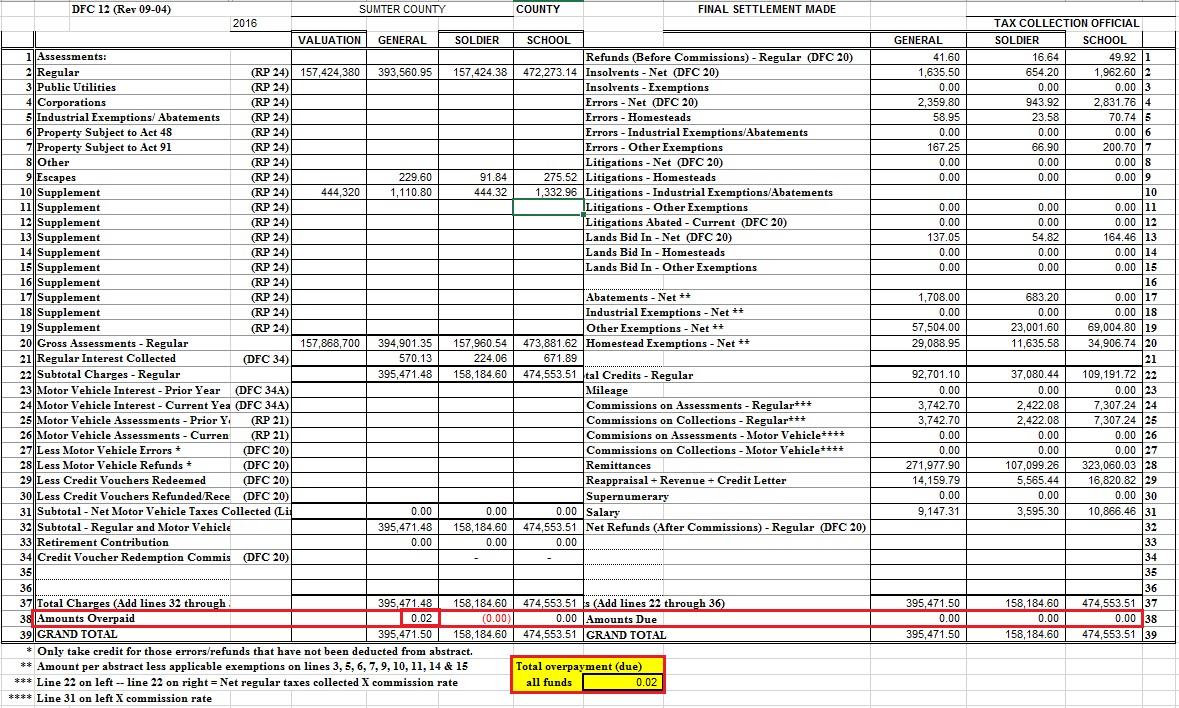

Validating the Final settlement:

· Verify if the values in abstract are matching with the final settlement and if any discrepancy occurs validate the values with the dumps provided.

Charges validation:

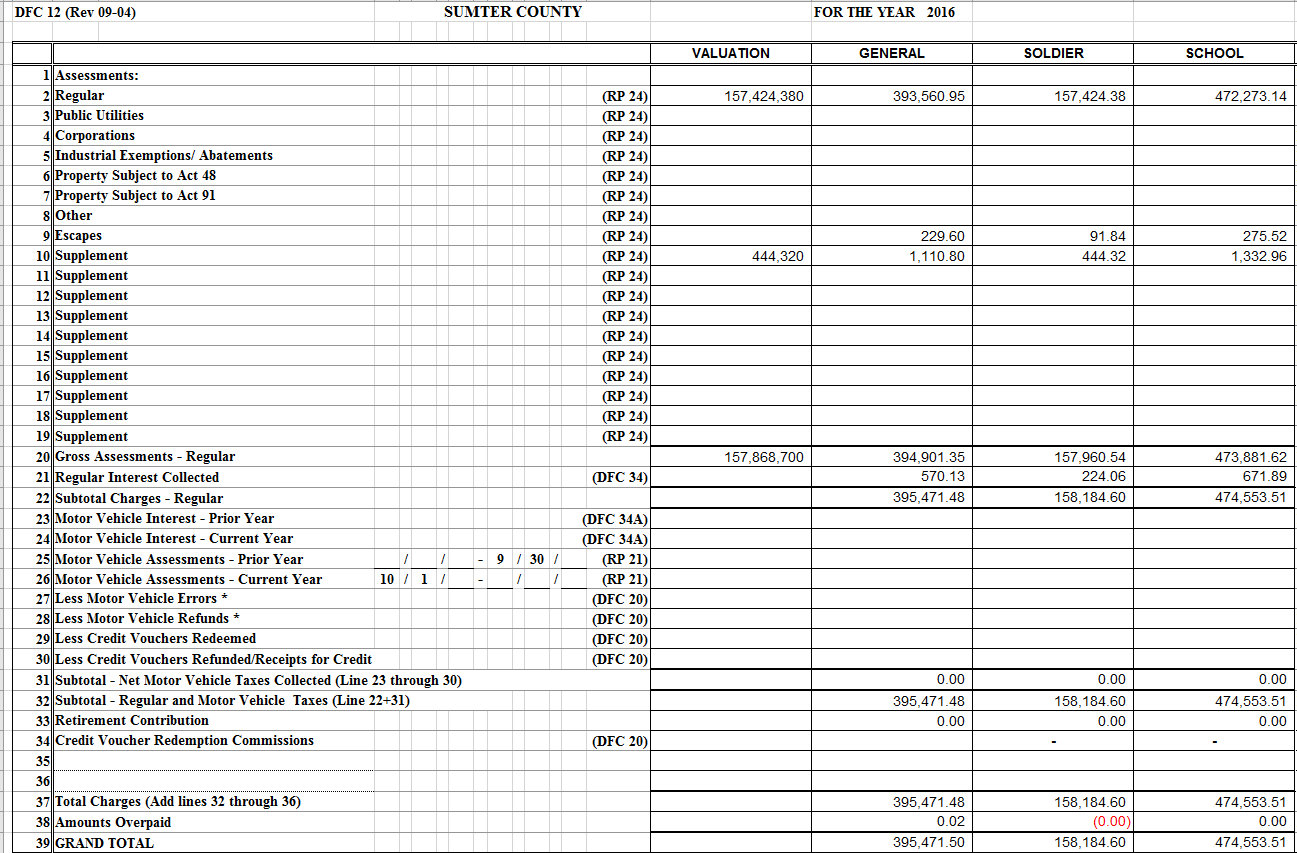

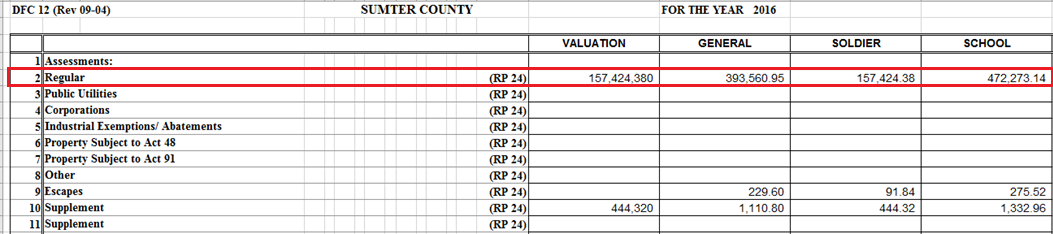

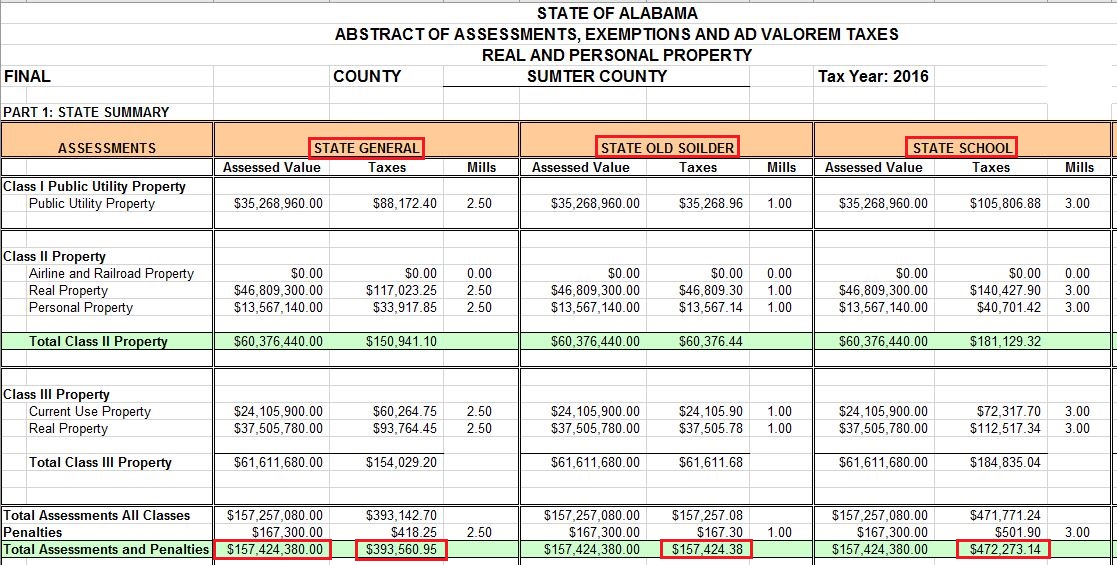

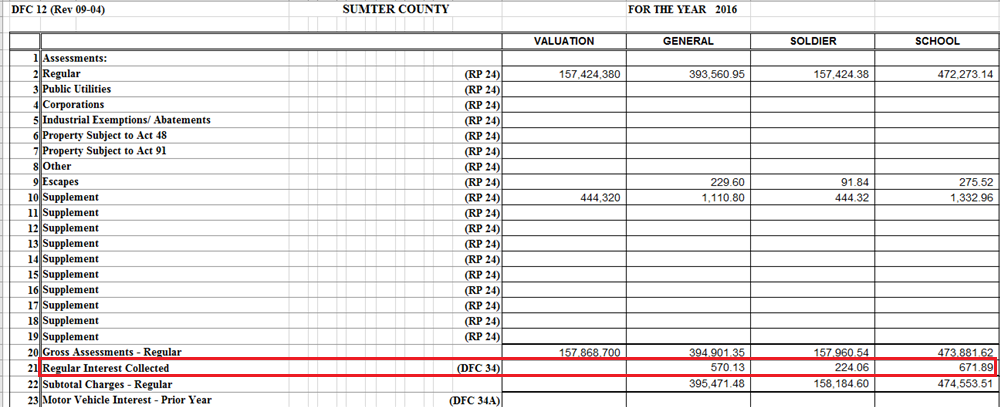

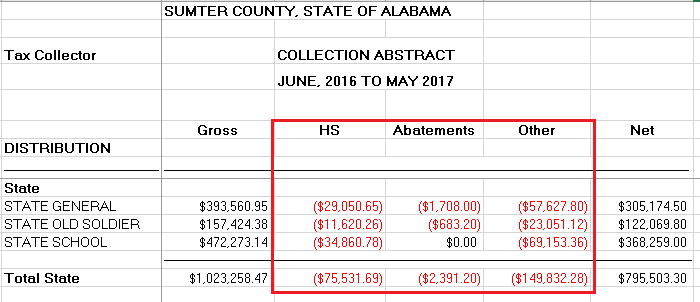

· Regular: User can validate the Regular assessed value ($157,424,380) and the Taxes for individual agencies either from the Abstract or from the Abstract report provided on the final settlement page.

Validating the Regular assessed value and Taxes from Abstract:

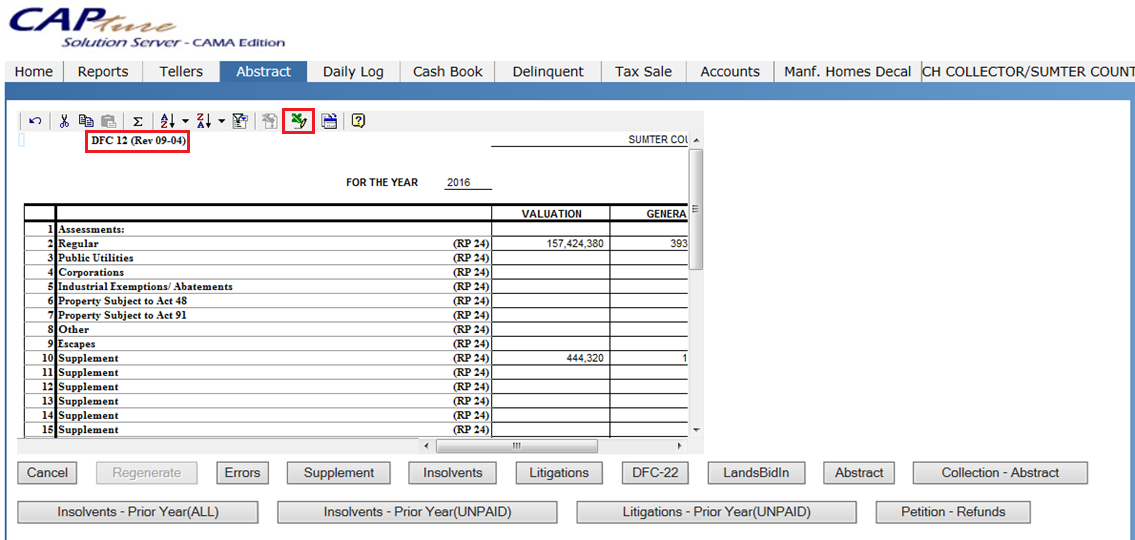

Validating the Regular assessed value and Taxes from the Abstract report: Click on Abstract button.

Note:

Similarly validate Escapes and Supplement values.

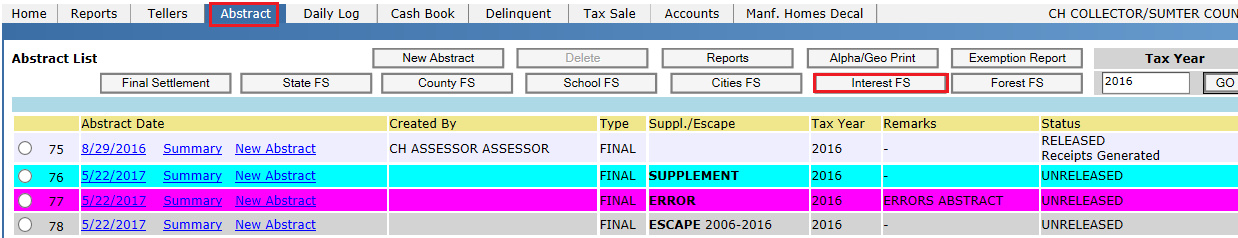

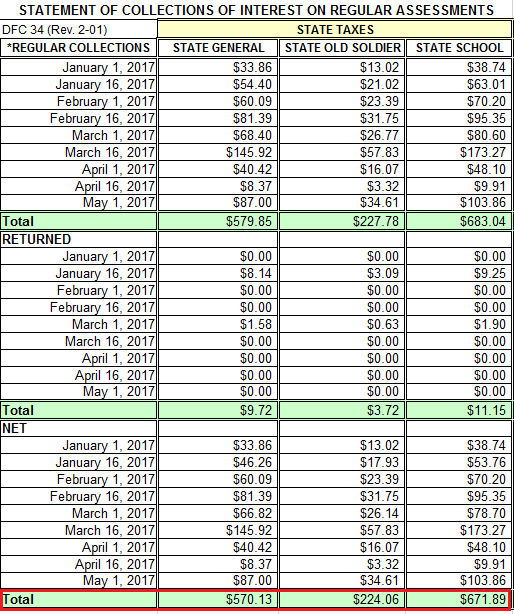

· Interest: User can validate the interest value for individual agencies either from the Interest FS or from the consolidated disbursement (Addition of interest values from all the disbursements for that collection year).

Validating the Interest value from the Interest FS: Click on Interest FS

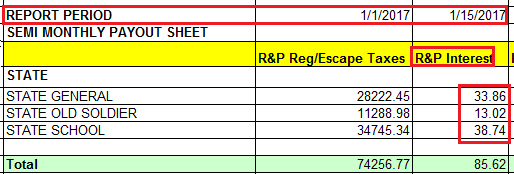

Validating the Interest value from the Disbursement: This is the interest disbursed for the period 1/1/2017 to 1/15/2017, similarly Users should add the interest values of all the disbursements to validate the interest value.

Amount overpaid: If the total charges are greater than the total credits then the amount overpaid will be zero otherwise it is equal to the difference between total credits and charges.

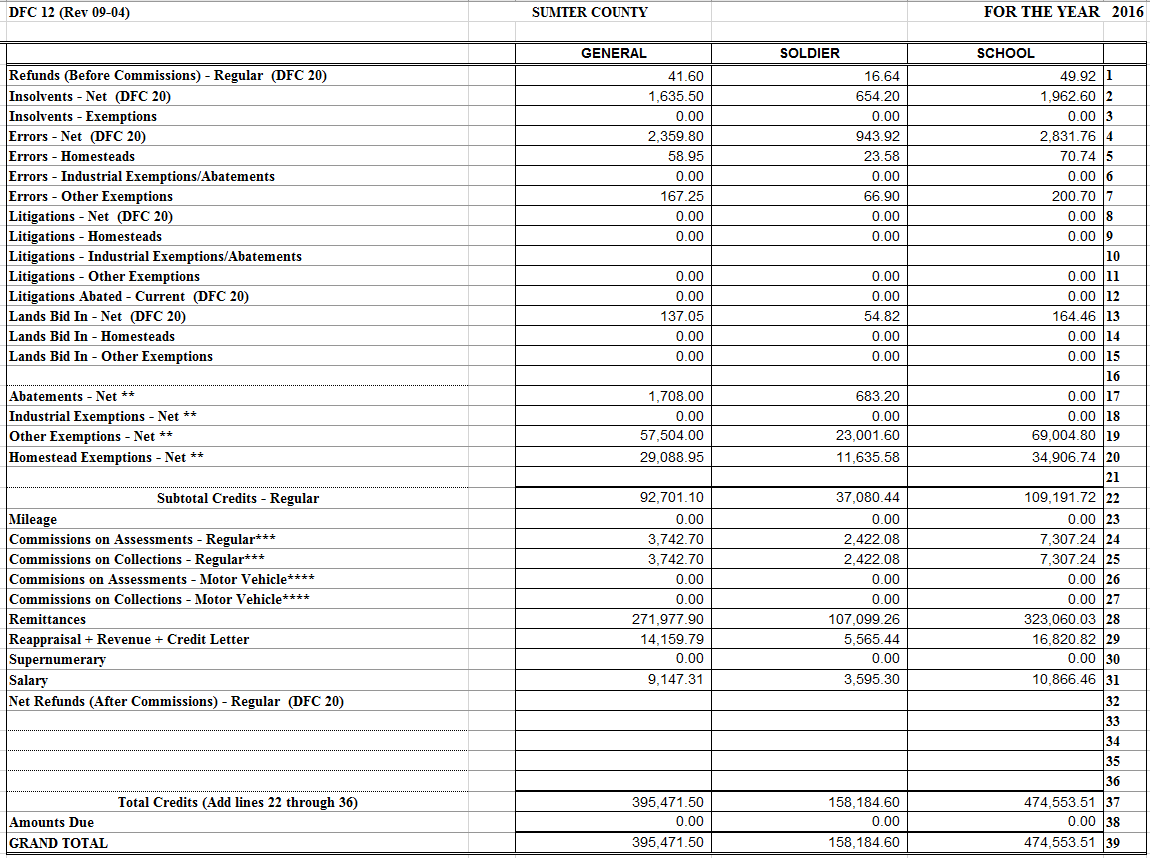

Credits validation:

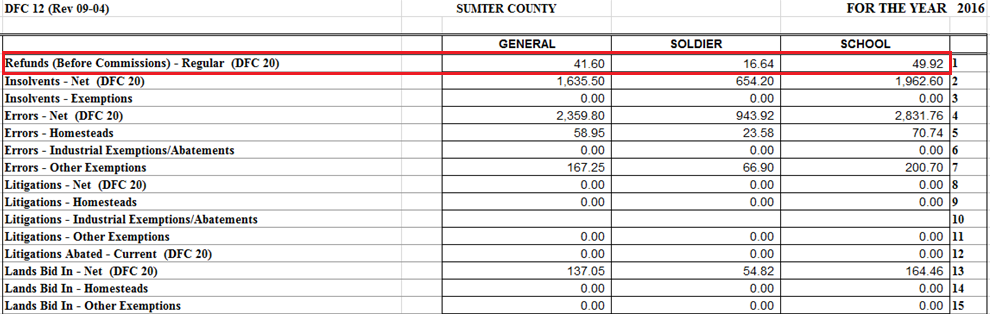

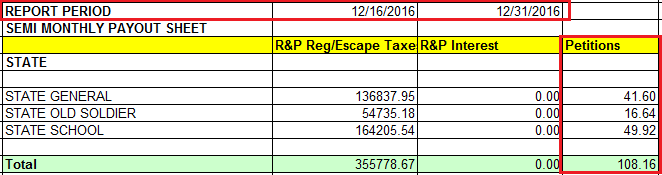

· Refunds: User can validate the refund value for individual agencies either from the Petition - Refund report provided on the final settlement page or from the consolidated disbursement (Addition of refund values from all the disbursements for that collection year).

Click on Petition – Refund button:

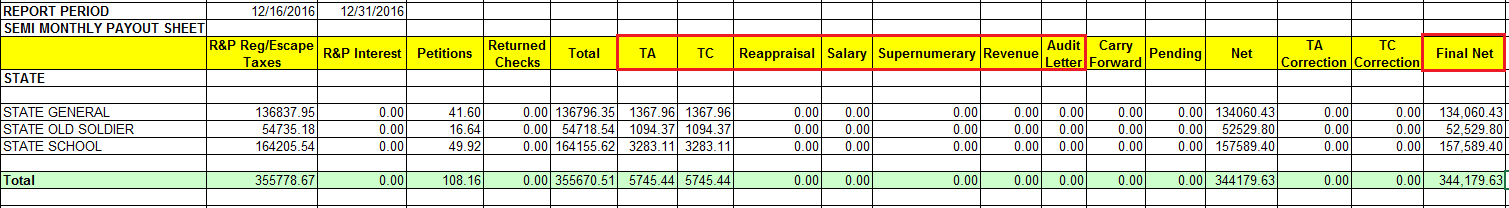

Validating the refund value from the Disbursement: This is the refund disbursed for the period 12/16/2016 to 12/31/2016. Similarly, user should add refund values of all the disbursements to validate the refund value.

Note: Similarly validate Insolvents, Errors, Litigations and Lands

Bid In values.

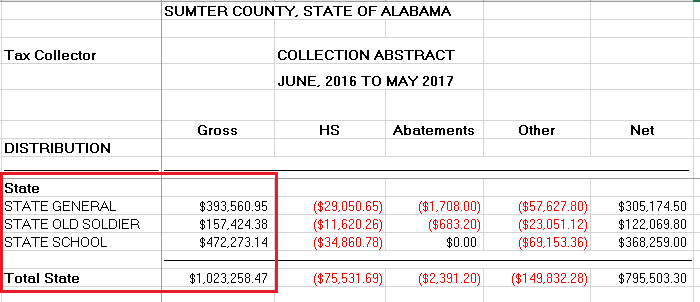

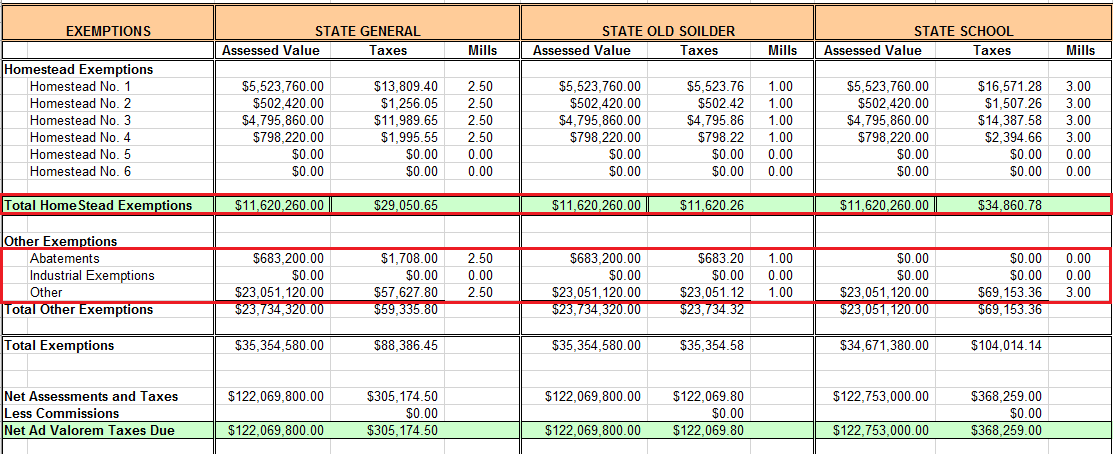

· Exemptions: User can validate the Abatements, Industrial, Other and Homestead Exemptions values either from the Abstract or from the reports in the final settlement page (Regular, Supplements, Errors and Escapes).

Validate the Homestead exemption value from the Abstract by using the below formula.

Homestead Exemptions Net = Homestead (Regular + Supplements + Escapes – Errors).

· Validate the Homestead exemption value from the reports in the final settlement page by using the below formula.

Homestead Exemptions Net = Homestead (Regular + Supplements + Escapes – Errors)

Note: Similarly validate Abatements, Other and Industrial exemptions.

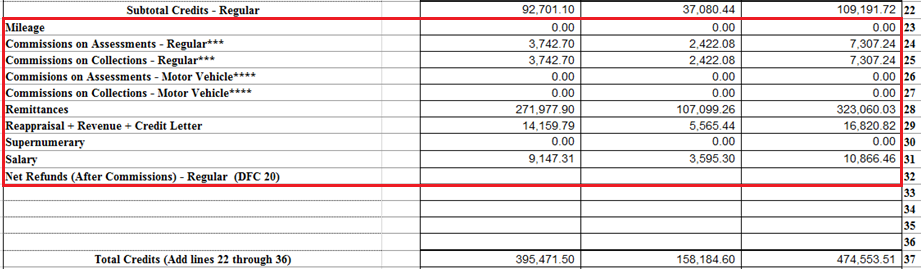

· Commissions (TA and TC): User can validate the Commissions, Remittance, Reappraisal, Revenue, Credit letter, Millage, Supernumerary and Salary from the consolidated disbursement (addition of all these values from all the disbursements for that collection year).

Validating the Commissions, Remittance, Reappraisal, Revenue, Credit letter,

Millage, Supernumerary and Salary from the consolidated disbursement:

Amount Due: If the total credits are greater than the total charges, amount due will be Zero otherwise it is equal to the difference between total charges and credits.

Validating Amount Overpaid and Amount Due:

In the Final Settlement, each, TA and TC withholdings equaled $3,742.70, instead of $3,742.69. This occurs because of how the commission amount is calculated for the Final Settlement reports. The reports calculate the interest based on the total amount collected for the entire collection cycle, but commission checks are disbursed with each semi-monthly. In each disbursement, the commission must be rounded to the nearest penny, but the Final Settlement report rounds the amount only one time. Over the course of the year, the rounded amounts can add up and create a small discrepancy. When one penny is subtracted, then the underpayment to the State Soldier of one penny disappears. The fund now settles at zero.

Example: The following table shows the abstract amount, error, escape and supplement amount for the state abstract for each State fund. The remittance is then compared to the new total taxes due. Any discrepancies are shown.

|

Sumter County: State |

|||

|

Amounts |

State |

Soldier |

School |

|

Original Abstract Amt |

$393,560.95 |

$157,424.38 |

$472,273.14 |

|

Error Amt |

$2,586.00 |

$1,034.40 |

$3,103.20 |

|

Supplement Amt |

$1,110.80 |

$444.32 |

$1,332.96 |

|

Escape Amt |

$229.60 |

$91.84 |

$275.52 |

|

New total collected |

$392,315.35 |

$156.926.14 |

$470,778.36 |

|

Remittance |

$271,977.90 |

$107,099.26 |

$323,060.03 |

|

Discrepancy |

$120,337.45 |

$49,826.88 |

$147,718.33 |

To find the new tax total collected, use the following formula:

Original Abstract Amt – Error Amt + Supplement Amt + Escape Amt = New Total Collected

State Fund: $393,560.95 - $2,586.00 + $1,110.80 + $229.60= $392,315.35

To find the discrepancy, use the formula:

New total collected – Remittance = Discrepancy

$392,315.35 - $271,977.90 = $120,337.45

What can be added/subtracted to get the abstract amount and Final Settlement remittance to balance?

Interest should be added and insolvents, litigations, parcels sold to state, exemptions, commissions withheld, budgets, and petitions should be subtracted.

Discrepancy + Interest – Insolvents – litigations - parcels sold to state - Exemptions – petitions – commissions – budgets

ð 120,337.45 + 570.13 – 1,635.50 – 0.00 – 137.05 –88,300.95 - 41.60 – 7,485.40 – 23,307.10 = $0.02

This discrepancy of $0.02 occurs because of how the commission amount is calculated for the Final Settlement reports. The reports calculate the interest based on the total amount collected for the entire collection cycle, but commission checks are disbursed with each semi-monthly. In each disbursement, the commission must be rounded to the nearest penny, but the Final Settlement report only rounds the amount one time.

Note: Similarly, User can

validate the County, School and City Final Settlements using the above

procedure.